Trip Interruption Benefits

What is Trip Interruption?

Trip Interruption offers coverage if a trip is disrupted or cut short due to unforeseen circumstances such as sicknesses, severe weather conditions, or other eligible events that are out of the traveler's control. Trip Interruption Coverage typically covers expenses such as the cost of additional transportation, accommodation, and other expenses incurred because of the interruption. The exact coverage and benefits vary depending on the insurance policy.

Is Trip Interruption necessary?

Whether Trip Interruption insurance is necessary or not depends on several factors, including the type of trip you're taking, the cost of the trip, and your personal risk tolerance. The Trip Interruption benefit can provide coverage for unexpected events such as sickness, weather-related cancellations, and other eligible events that can cause you to interrupt your trip.

Trip Interruption also allows travelers to rejoin their trip after an interruption has occurred.

In general, having a trip interruption is a personal decision that should be based on the traveler's specific needs and circumstances. However, it's always a good idea to consider trip interruption coverage, especially if the trip involves a significant investment of time and resources. This can help to protect against financial losses if the trip is interrupted for a covered reason.

What Qualifies as Trip Interruption

1. Sickness, accidental injury, or death that results in medically imposed restrictions as certified by a physician during your trip preventing your continued participation in the trip

A physician must advise to cancel the trip on or before the scheduled return date

2. If a family member or traveling companion booked to travel with you incurs sickness, accidental injury, or death. A & B must occur:

a.) While you are on Your trip

b.) Requires necessary treatment at the time of interruption, certified by a physician that results in medically imposed restrictions to prevent that person’s continued participation on the trip

3. In case of sickness, injury, or death of a non-traveling family member

4. The death or Hospitalization of Your Host at the Destination during Your trip

5. If you are terminated or laid off from your full-time employment by your company through no fault of your own, one year or more after starting employment, during your trip

6. You transfer your employment more than 250 miles away from your home during the trip. This applies if you have been employed by the transferring employer since your policy's effective date and the transfer requires you to relocate your home

7. If your previously approved military leave is revoked or you experience a military reassignment during the trip

8. If you, your traveling companion, or a family member who is military personnel is called to provide aid or relief in the event of a natural disaster (excluding war)

9. Severe weather causes the complete cessation of services for at least 48 consecutive hours of the common carrier (e.g., airline), preventing you from reaching your destination.

Note: This benefit does not apply if the natural disaster was predicted or a storm was named before you purchased this policy

10. If a natural disaster at your destination renders your accommodations uninhabitable

11. If a terrorist incident occurs in your departure city or in a city listed on your trip itinerary during your trip, and the travel supplier does not offer a substitute itinerary.

Note: This does not cover flight connections or transportation arrangements to reach your destination. The scheduled departure date must be within 15 months from your policy's effective date. Terrorist incidents that occur on an in-flight aircraft are not covered

12. If you or your traveling companion are victims of a felonious assault during the trip

13. If you or your traveling companion are hijacked, quarantined, required to serve on a jury, or subpoenaed if your home is made uninhabitable by a natural disaster or experience a burglary at your principal place of residence during the trip

14. You or Your Traveling Companion are directly involved in a traffic accident en route to departure.

Note: This must be substantiated by a police report obtained by you and presented along with other claim forms and documentation.

15. If a travel supplier goes bankrupt or defaults during your trip, resulting in a complete halt of their services. However, these benefits will only be provided if there is no other transportation option available. If there is an alternative way to reach your destination, the benefits will be limited to covering the change fee required to transfer to another airline.

Note: This coverage applies only if your scheduled departure date is within 15 months from the start date of your insurance policy

16. Strike that causes complete cessation of services of the common carrier affecting you or your traveling companion who is scheduled to travel. Note: Strike must last for at least forty-eight (48) consecutive hours

File for a free quote

Do I need Trip Interruption coverage?

Having trip interruption coverage is a savvy idea. It offers coverage for multiple reasons to help you get your trip back on track.

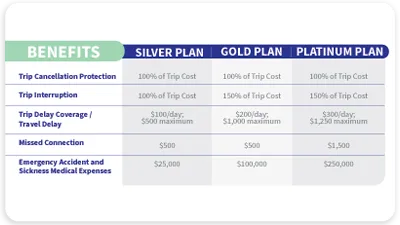

All three of AXA’s travel plans include Trip Interruption coverage, maximum coverage per person is up to:

Silver

Maximum Benefit: 100% of Trip Cost

Reasonable Expenses Per Day: $100

Gold

Maximum Benefit: 150% of Trip Cost

Reasonable Expenses Per Day: $100

Platinum

Maximum Benefit: 150% of Trip Cost

Reasonable Expenses Per Day: $100

Receive a free quote within minutes, and decide which plan fits best for your travel needs!

Why choose AXA Travel Protection?

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include:

• Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency

• 24/7 global team of travel experts that offers assistance and assurance while traveling

Trip Interruption Insurance FAQs

How much does Trip Interruption cost?

The cost depends on several criteria:- Length of Stay

- Destination

- Type of Trip

- Number of Travelers

- Extent of Guarantees

What types of vacations does Trip Interruption apply to?

Trip Cancellation is applied to any type of vacation. Whether you are going on a cruise, tour destination, flight, domestic travel, or international travel, trip cancellation coverage is applied.When does Trip Interruption coverage begin?

Requirements before coverage may begin- Trip Interruption coverage begins when a specific travel package has been selected

- Trip Interruption coverage will begin on the day after the required premium for such coverage is received by the authorized representative

When does Trip Interruption coverage end?

Coverages will end the earliest of the following:- The scheduled return date as stated on the travel tickets

- The date and time you return to your origination point if prior to the scheduled return date

- The date and time you deviate from, leave, or change the original trip itinerary (unless due to unforeseen and unavoidable circumstances covered by the policy)

- If you extend the return date, coverage will terminate at 11:59 P.M., local time, at your location on the scheduled return date unless otherwise authorized by the Company in advance of the scheduled return date

- When your trip exceeds ninety (90) days

- The return date as stated on your purchase confirmation

How to get a Travel Protection Quote?

Receive a free quote within minutesOr call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors.

Monday-Saturday, 8 AM-7 PM Central Time

Disclaimer: It is important to note that the specifics of trip interruption will depend on the date of purchase and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have