Emergency Medical Benefits

Emergency Medical Benefits

What is an Emergency Accident & Sickness Medical Expense?

In the event of an accidental injury or sickness that warrants immediate medical attention during your trip, this benefit may provide reimbursement for eligible medical expenses covered by the policy up to the maximum benefit.What warrants a Medical Emergency?

In general, medical emergencies are defined as unexpected illnesses, injuries, or medical conditions that require immediate medical attention.

Some examples of medical emergencies include:

• Accidents, such as a broken bone or a severe burn

• Illnesses, such as a heart attack, stroke, or appendicitis

• Allergic reactions or anaphylaxis

Covered Medical Expenses

Some examples of medical expenses include:- Services of a physician

- Hospital confinement, operating rooms, hospital or ambulatory surgical services

- Ambulance services

- Anesthetics, x-ray examinations or treatment, and laboratory tests

- Drugs, medicines, and therapeutic services

Is Emergency Medical Expense coverage necessary?

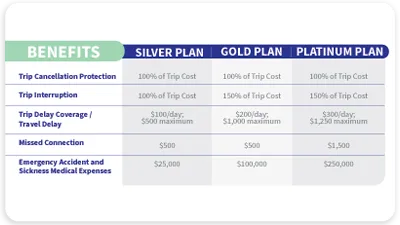

All three of AXA’s travel plans include Emergency Accident & Sickness Expense coverage. Maximum coverage per person is up to:

Silver

Maximum Benefit: $25,000

Dental Expenses: $5,000

Gold

Maximum Benefit: $100,000

Dental Expenses: $5,000

Platinum

Maximum Benefit: $250,000

Dental Expenses: $5,000

File for a free quote to see the full range of coverage details.

Note: If you are hospitalized due to an Accidental Injury or a Sickness that first occurs during the trip, beyond the scheduled return date, coverage will be extended for up to ninety (90) days or until you are released from the Hospital or until you have exhausted the maximum benefits payable under this coverage, whichever occurs first.

Other Travel Insurance Benefits: Trip Cancellation, Emergency Evacuation, Baggage Loss, Cancel For Any Reason, Trip Interruption, Medical Travel Benefit, Trip Delay

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Is Travel Insurance necessary?

While travel insurance is not mandatory, it is highly recommended as it can offer protection against unforeseen circumstances that may arise during your trip, such as trip cancellations, lost or stolen luggage, and medical emergencies.Why choose AXA Travel Protection?

With a global presence, AXA provides assistance with a wide range of features that include:- Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency

- 24/7 global team of travel experts that offers assistance and assurance while traveling

How to get a Travel Insurance quote

Receive a free quote within minutesOr call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors.

Monday-Saturday, 8 AM-7 PM Central Time

Disclaimer:

It is important to note that the specifics for Emergency Accident and Sickness Medical Expenses will depend on the policy selected, date of purchase, destination, and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have.

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.